Payroll Plus

This module will take care every thing related to Pay. It will permit you to define different pay structure for different cadre and also allow you to define pay structure as per your requirement. You can define a perk in four different ways ( Individual, Fixed, Slab, percentage. ).

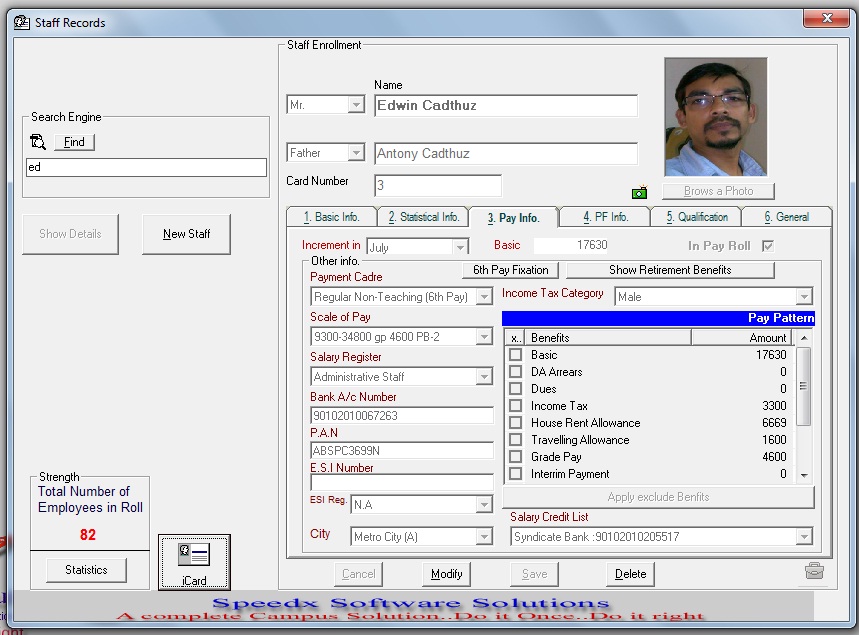

Employee records of speedx are very comprehensive and detailed in nature. Speedx store employee/faculty information with necessary parameters required for modules like Payroll, Income Tax, Timetable, Library etc. The information are stored in 5 Tabs:

1.Basic Info: Address and ware abouts of the employee

2.Statistical Info: Date of Birth, Appointment date, Confirmtion date, Promotion date, Left date, Nationality, Bloodgroup etc…

3.Pay Info: Payment Cadre, Scale of Pay, Salary Register, Bank Details, Pay template etc.

4.PF info: PF A/c No, Date of Joining, Date of Leaving etc.

5.Academic Info: Qualification, Designation, Profile, % of marks etc

Pay Definitions can be done at end user level. One can define any pay benefit that suits to their logic and existing pay policies. Speedx pay definition wizard allows you to define any benefits with : percentage in nature, slab in nature, individual in nature, percentage of combinations of other benefits, overtime, loan etc…etc

Salient Featurs:

1 Loan and repayment in installments

2 D.A Arrear Calculations

3 Bonus

4 PF Challans, Form-12A, Form 3A, Form 6A, Annual Return and data-preparation to floppy/CD

5 ESI

6 Annual Increment Handler,

7 Linking with Income Tax module

8 Link with Time-Office

Loan Management, ESI, PF, Over-Time

• Reports

This system will generate all kind of reports related to Payroll monthly, yearly or for any given period

Pay Roll Unit wise

Pay slip Unit wise

Pay register

Aquittance Roll

Individual Payment Statement for the year

Consolidated Salary Register for the year

Salary Certificate

Bank Statement

Experience Certificate

• PF Challan

• Additional Challans

• ESI Challan

• Form 12A

• Form 6A

• Form 3A

• Data-Preparation Utility for Annual Returns

• Form 10

• Form 5